The proposed AT&T / Time Warner merger is certainly a headline grabber with not only two iconic corporate names involved but an amazing $85 billion dollars on the table. It is the latest turn in the evolving picture of technology and distribution meet content. All the major players want access to the consumers across whatever devices they use AND they need to content to keep their attention. Access without content is not a winner and neither is the content without multiple distribution options.

In a broader context, the entertainment options available today are so widespread, it is really difficult to narrow one’s market focus in the hopes of achieving success. Today’s consumers can spend their discretionary dollars in so many different ways. Just like any other industry in this global economic climate, the entertainment companies are searching for growth – – the result will likely be that we see more of these deals along the lines of AT&T / Time Warner.

We took a dive into the Global 5000 database to look at the market for and growth of the entertainment providers. To do this, we used a liberal definition of the entertainment industry and included firms from Disney to Netflix, Time Warner, Facebook, Carnival Cruise Lines, QVC, Mattel, Callaway Golf and Nintendo. Firms that look for consumers with extra time and extra money to spend.

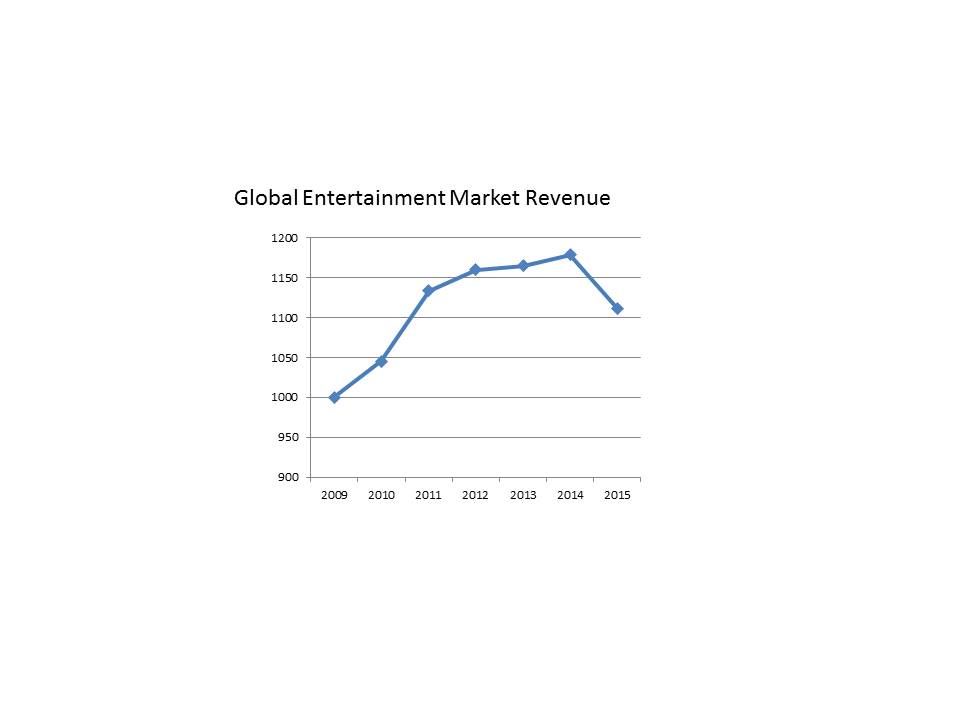

There are 150 in all. They were doing ok from 2009 thru 2014 and then 2015 is when the consumers hit the brakes. Compound annual growth in this stretch was only 1.8%. It was running at 3.3% until 2015 finished as a down year and the overall totals look more like a 2011 level.

Until the global economic picture turns bright again, we can expect more languishing – which means more deals will be down to try & find growth and spark shareholder (stock prices) value.

The chart below shows the indexed results of these 150 entertainment firms starting with the base year of 2009.