As we sit at the front end of what will be the totally economic and social upheaval year 2020, the airline industry serves as perhaps the starkest example of the coronavirus impact. Virtually all commercial airline traffic has been shut down.

While the extent of the economic toll of COVID-19 will not be known for many months (or perhaps years) we can take a look at the previous economic shock that took place in the financial crisis 2008 to see if there are any indications as to how the airline industry might bounce back.

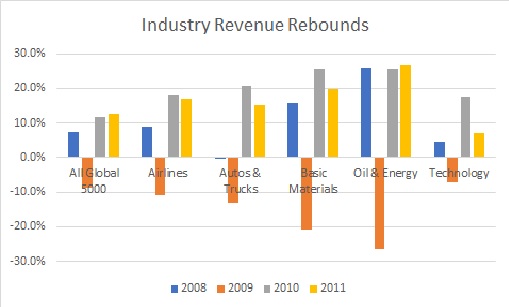

The 2008 recession was a financial one driven by structural issues in the financial markets. In that period, 2008 revenue for the Financial Industry was negative while all the other industries were slowing but still positive. Then 2009 revenues were negative for all the other industries. The recovery / bounce-back was quick and markets jumped up quickly. The airlines were no exception and bounced right back with Global 5000 airline companies reporting 2010 revenue up by 18% compared to 2009.

Airlines’ revenue had one of the best bounce-back rates – along with Auto’s, Basic Materials, Technology and the Oil companies.

The footprint of the airline industry is sizeable. There are 66 airline companies as part of the Global 5000 database. Their total annual revenue is $687 billion and they employ more than 2 million.

The top 10 airline companies are listed below and these are the firms we have to watch as leading indicators for the shape of any airline industry (and overall economy recovery.

- American Airlines Group

- Delta Air Lines

- Lufthansa Group

- United Continental Holdings

- Air France-KLM Group

- International Consolidated Airlines Group

- Emirates Group

- Southwest Airlines Co.

- China Southern Airlines

- Air China Ltd

What does a recovery look like?

We have seen plenty of speculation regarding the airlines in the media as the COVID-19 crisis unfolds and it is really too early to tell how the economic downfall will play out.

Some articles such as this one point to how steep the decline is and will be.

Others (probably more wishful) write about the bounce-back as it reports on a survey showing pent-up travel demand.

But, for the most part, it is a bleak picture coupled illustrated by warnings from Delta indicating demand fell by 95% in April and Virginia Australia’s collapse with Branson’s vow to mortgage his Island paradise.

We doubt that this recovery (whenever it starts) will look like 2008/2009 for the airline industry. Today, some of the drivers behind airline travel will have been changed for a long time to come.

- Given our social distancing learned experience of the past few months, how long will it be before most people will look forward to being jammed into an aluminum tube with 200+ fellow passengers with not 6 inches (never mind 6 feet) between them

- It will likely be quite a while before cruise ships will be sailing with any reasonable numbers resulting in less traffic for the airlines to bring passengers to cities where ships dock.

- The same goes for major vacation resorts like Disney and the like

- And the biggest concern of all is the number of people out of work for a period of time and the jobs lost. That all translates into fewer dollars available to spend on discretionary items like travel and vacations.

In total, we believe this time will be different. The underlying drivers are different and we have not historical data to show us the way. We’ve not seen this before.

However this plays out for the airline industry, we will likely be using the phrases “pre-pandemic” and ‘post-pandemic” for the foreseeable future.