When Amazon (#20 on the Global 5000 rankings) announced they were pulling out of their HQ2 location in New York, a wave of press, comments & criticisms flooded the media. Among the cries for change we found some calling for the breakup of Amazon as it has become too big. Obviously an emotional, ‘in-the-moment’ jump to judgement.

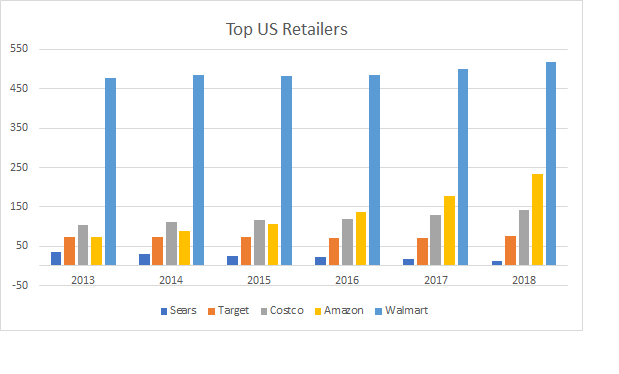

We thought it would be instructive to look at some facts relating to Amazon and some of its competitors in the retail market. In the chart below, we took the revenues from Global 5000 companies Amazon, Walmart, Costco, Target and Sears from 2013 thru 2018.

A couple things are clear here:

- Every player is small compared to Walmart. Even with Amazon’s rapid growth over the past couple of years, if it doubled in size, its revenue would not equal Walmart – so, where are the cries to ‘break up Walmart’ ?

- Costco has had a nice growth run, but still small in comparison

- Sears is but a blip . . . and a shrinking one as we know.

- Target is huge ($70+ billion) but relatively flat compared to the others.

- And, this data does not include other classes of retailers like the big food chains, specialty big box retailers like Best Buy or Home Depot or Loew’s. Not the big drug stores like CVS or Walgreen’s either.

Bottom line – the retail picture is complicated. It is ever-changing and rather than lash out at the spur of the moment emotional response, it might make sense to look at the total picture. For all the talk about data-driven economy & decisions, we have a ways to go before the data is at the forefront of our thinking process.