It was just announced that Chevron will be acquiring Anadarko Petroleum. Chevron recently posted revenue of $158 billion while Anadarko’s was $13 billion. No sooner had the release been posted when we started to read headlines and opinions questioning whether this might the start of a wave of merger activity in the Oil & Gas industry.

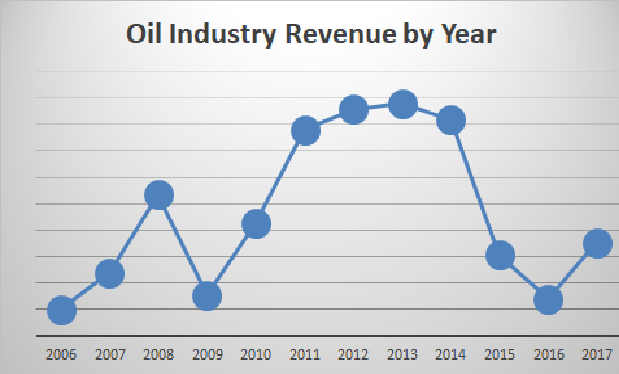

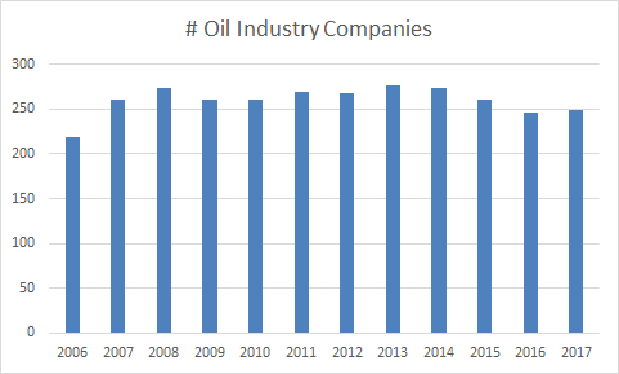

That prompted us to take a look at the Oil & Gas companies in the Global 5000 and how much has changed over the past few years. The charts below show 2 interesting things — one is the volatility of energy prices over the past few years and the other is the stagnated number of companies in this industry.

So, this acquisition will just add to the continued profile where the big just continue to get bigger and the industry continues to consolidate. As this happens, pricing will be controlled by a few and we can expect to see revenue climb.

The top 10 companies in this industry are:

- Saudi Aramco

- Sinpoec Group

- China National Petroleum

- Dutch shell

- BP

- ExxonMobil

- Vitol Holding

- Total SA

- Chevron Corporation

- Gazprom