We continue to keep a close eye on real estate companies in the Global 5000 database as the effects of the global pandemic reach into the summer months. The effects are not as sharp nor felt as quickly as other industries like restaurants or travel, but with incomes for many suddenly halted, some significant market adjustments will be required.

In many places, renters have been given a grace period to pause their rents. Landlords have to negotiate with lenders to get some reprieve on mortgage payments that come due every month. All this leads to lower income for businesses associated with real estate. Mortgage lenders including Lending Tree and Quicken Loans will look to re-group. Ripple effects will also be felt by banks with mortgage portfolios as well as home builders as those markets will slow.

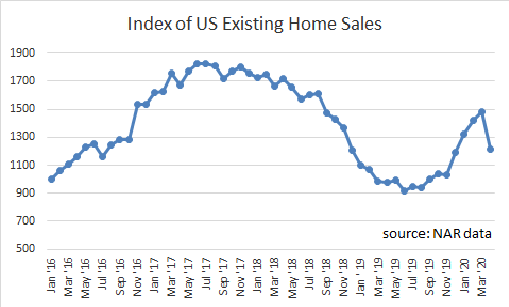

On the consumer side, it seems inevitable that home sales will slow. We have been tracking monthly US sales data from the National Association of Realtors (NAR) and have created an index showing the year over year change in monthly sales on this chart. April was the first month that sales data was impacted by COVID-19.

Most of the 120 real estate companies in the Global 5000 database are on the commercial side and the biggest players have a construction development component to their business and are in developing countries. These 120 Global 5000 companies have combined revenue of $838 billion. Annual revenue growth over the past few years (chart below) has bounced around a bit with 2018 a boom year with 19% revenue growth.

The top 10 (by revenue) real estate companies are:

| WTorre S.A. Country Garden Holdings Company Limited Greenland Holding Group China Vanke Co Ltd CK Hutchsion Holdings Limited Poly Real Estate Group China Overseas Land & Investment CBRE Group, Inc. Sunac China Holdings Ltd China Resources Land |

While the retail (consumer home purchases) will eventually follow the flow of various economies as they recover from the pandemic impact and eventually grow along with GDP and consumer income growth, the commercial side will likely face more structural and substantive changes over the next few years.

For as long as most of us can remember, a company without an office is really no company at all – but with so many working from home, there are big questions regarding how these routines will carry over to whatever the new normal looks like. Will newly adopted habits result in less office space be needed going forward? Big implications for office REITS and the “WeWork” operations of the world. For the business property owners, there will be the additional pinch of renters (businesses) failing. Many commercial properties are highly leveraged. There will have to be a lot of give & take in these uncertain times. Many commercial leases are 10 years in length so there may not be an immediate impact – but we have already seen reports that some major players have put a halt to looking at properties for additional space. There will be some period of time where commercial renters will reassess their needs and perhaps right-size their office / commercial space.

Retail space including shopping mall operators has been under pressure for some time as the move to online shopping has been on the march for years. The pandemic shutdown has only accelerated that pace. In big cities, retail space may get turned into housing as an option. In the suburbs, mall operators will always get creative and those spaces will find new and different tenants that may not look like classic shopping centers.

In the past, real estate has been slower to react to market downturns, so we likely won’t see much until 2021 or 2022. We can be assured that lots of change is coming and there will be plenty to watch and keep tabs on.