Like businesses in every industry, retail companies are anxiously waiting for the signal that they can re-open operations from the global pandemic. The composition of retail is as diverse as any industry and the impact of the economic hit from the coronavirus will be quite different for the different sectors within retail.

We are now seeing some major companies declaring bankruptcy as they have been weighed down by heavy debt loads – J. Crew, Debenham’s in the UK and most recently Neiman Marcus – and these won’t be the last.

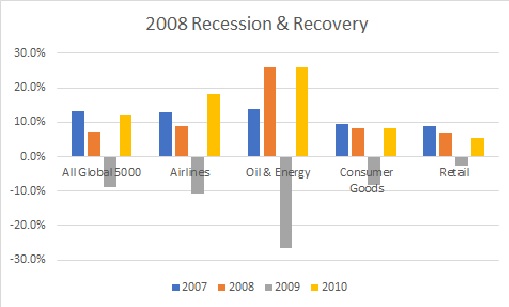

The retail landscape is quite complex as can be noted by the different areas described below. In the last recession (2008 timeframe) retail was a steady factor not subjected to the whipsawing downs & ups we saw in other industries. The chart below shows how retail fared in that period compared to a few other impacted industries.

This time (post pandemic) we are likely to see a similar picture of moderation in the overall retail space as a few of the big players seem to be adapting and offering some clear advantages while some others are struggling and have been struggling due to the evolving market environment over the years. This COVID-19 pandemic is accelerating the pace and not always causing retail struggles.

In the Global 5000 database, there are 405 companies representing annual revenue in excess of $6 trillion – approximately 10% of the revenue for collective Global 5000. These companies employ 22 million people across the globe.

The Top 10 retail companies (by revenue) are:

- Walmart, Inc.

- Amazon.com

- CVS Health Corporation

- Costco Wholesale Corporation

- Walgreens Boots Alliance, Inc.

- Kroger Company

- Home Depot, Inc.

- Lidl Stiftung & Co

- Carrefour SA

- Aldi (ALDI Einkauf GmbH & Co)

Different aspects of the retail industry have provided some of the most compelling representation of the COVID-19 way of life.

- Restaurants throughout the world have been shuttered for a period of time. While, certainly major chains (which are included in the Global 5000) have suffered, a far wider impact is felt from the millions of individual local restaurants. Many of these operate on razor thin margins and are not funded from deep pockets. Even when cities and towns are back open, it is not clear how many of these may not open. For those that will open, the is real uncertainty as to what new operating procedures and social distancing will do to this part of the retail economy.

- On the other end of the spectrum are the internet retailers like Amazon.com, super retailer Walmart and pharmacy company CVS Healthcare. All three of these are huge, all three have plans to hire huge numbers of new employees and all three have a major direct to consumer focus. Streamlined ordering, home delivery and contact-less transactions are all a big plus in this environment. These businesses are not experiencing major business growth just because of the virus environment – they have been on this track for a number of years. Current market conditions are pushing them further and faster.

- On the other end of the spectrum are the internet retailers like Amazon.com, super retailer Walmart and pharmacy company CVS Healthcare. All three of these are huge, all three have plans to hire huge numbers of new employees and all three have a major direct to consumer focus. Streamlined ordering, home delivery and contact-less transactions are all a big plus in this environment. These businesses are not experiencing major business growth just because of the virus environment – they have been on this track for a number of years. Current market conditions are pushing them further and faster.

- Contrast these with the traditional general merchandise retailers – Macy’s, JC Penny or Neiman Marcus – all who have been currently mentioned as considering bankruptcy. And when they do open, how many shoppers will be willing to head to a local mall and mix with the crowds to shop these stores. Most of these retailers were being challenged before the shutdown. This will likely be the tipping point for a number of them.

- Grocery stores and what they represent in the food chain are yet another affected sector in the retail landscape. Not only have they become front line workers, but the ramifications of the food supply chain and packaging challenges are most evident when we all go to the rood store. We are not eating in restaurants or traveling and eating ‘on the road’ and universities have sent their students home along with school aged children. Everyone is at home. And Eating. All of which drive increased demand to the food stores.

The bottom line here is that while the shutdowns have and will cause harm to many – others will flourish and grow. In time we will see innovation and new businesses start up as the retail experience will change forever for many. The real stories will be told in individual market niches and companies that can swiftly pivot to the current environment.