When the results from the UK referendum vote were posted a few days ago, so many questions have popped up and a murky picture of the the future is all that can be seen so far. Naturally, the stock market and UK currency felt the most immediate (and somewhat knee-jerk) reaction.

Key among the most pressing issues is the flow of goods and services across borders and concerns over the impact on large, global companies. We decided to take a look at those Global 5000 companies in Europe, headquartered in EU countries and in UK.

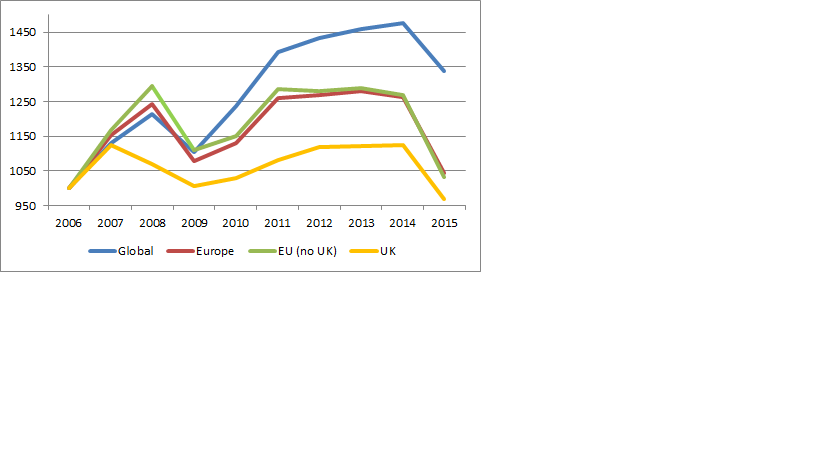

Our data on the Global 5000 starts in 2006. We built and index starting in 2006 and measured the growth in total revenue for each set of companies year on year up to and including 2015.All revenue was converted to USD using an average conversion rate for the year reported.

The blue line shows the revenue growth/change every year for the world – -the entire Global 5000.

Then we looked at all of Europe – the red line and then those companies headquartered in EU countries (not including UK in this set). Finally, the yellow line shows the UK based companies.

In essence, the overall Europe and the EU companies have been running in parallel with very little to choose between them.

The UK based companies have been the weakest over the years compared to the rest of the markets.

At the end of the day, these companies will still be big players and markets will adjust to whatever trade agreements get negotiated. The lower growth UK business entities coming out of the EU won’t damage the growth prospects of the EU based companies.