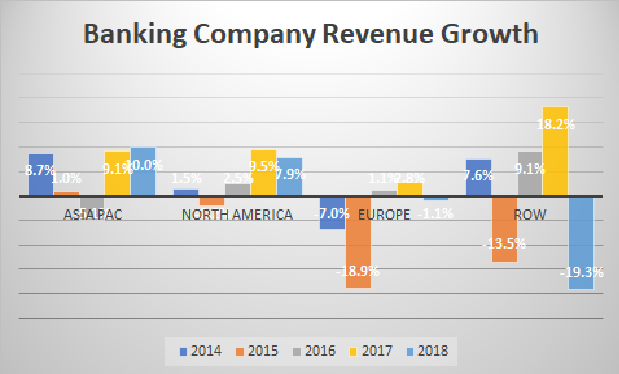

With a cloudy economic growth outlook and talk of recession as markets head into the final months of 2019, there have been analyses pointing out that European banks are looking weak. From that, we decided to look at the banking industry players by various region and see where the growth has been. And it is true – European bank revenue over the past few years has been a laggard compared to other regions.

To examine the data, we selected Financial Services segments and eliminated insurance companies, the credit services & credit card firms as well as the securities segment. That left us with 464 banking related companies.

We then separated them by region — Asia Pac, North America, Europe and ROW — then looked at the revenue growth since 2013 for companies based in those regions.

The results shown in the chart below show that, in fact, Euro banks have been the weaker area compared to those in other regions. ROW is the smallest and subject to wild swings which is not surprising considering the nature of emerging economies, currency fluctuations and dependence on specific country resources to drive revenue. North American banking has been the steadiest while Asia Pac has been the strongest growth engine due mostly to the economy in China.