It is pretty clear that once countries around the globe come out of the COVID-19 economic shutdown, recovery and growth will be uneven and will travel a rocky road. Part of the ‘rocky road’ aspect will be the devastation of some industry groups – restaurants for example. In some cases, the public have embraced different habits – perhaps more work from home days. Still others will have to navigate the roads where multiple challenges have been put into place – the oil industry entered a turmoil phase as a result of OPEC decisions (or lack thereof) just as the COVID-19 virus was hitting pandemic levels.

Real Estate is one of those industry segments bound to take a hit as well. Incomes for many have dried up or will be diminished. Some will be challenged to pay their mortgage. Companies like Lending Tree and Quicken Loans will look to re-group.

Open houses have been put on hold in most major metropolitan areas as people will be sheltering in place. Sales will drop. One potential change here will depend on how much of the business can now be virtual? What did the industry learn during the shutdown? Virtual open houses? Could closings be done remotely rather than in person?

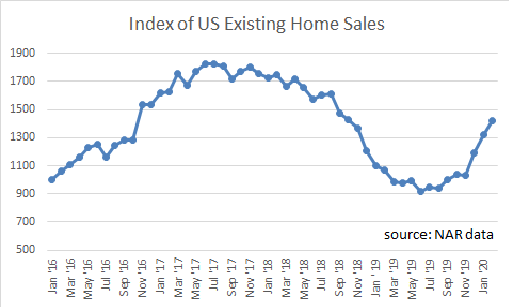

The chart below shows the monthly year-on-year change in US existing home sales. The data is based on monthly reports from the National Association of Realtors (NAR). The start date began with the January 2016 results. We wouldn’t expect to see much of a difference until April 2020 (perhaps somewhat with the March data).

And, of course, there will be a trickle down effect to home builders like Lennar, Beazar, and Pulte.

On the business side, with so many working from home — a big question will focus on how these routines will carry over to whatever the new normal looks like. Will these newly adopted habits result in less office space be needed going forward? Big implications for office REITS and the “WeWorks” of the world. For the business property owners, there will be the additional pinch of renters (businesses) failing and/or needing some rental leniency and the mortgage payment to the bank still due. Many of these properties are highly leveraged. There will have to be a lot of give & take in these uncertain times.

Looking at the Global 5000 real estate companies, we have 120 companies representing over $840 billion in revenue last year. 2018 was a great year when revenue grew over 17%. Last year, revenue growth 3%. There are many large real estate development firms in China (Country Garden Holdings, Greenland, China Vanke). Major real estate related firms in the US include CBRE, Jones Lang Lasalle and Cushman & Wakefield.

There is a good update on some of the real estate market challenges posted on LinkedIn 25March2020.

Lots of change coming. Plenty to watch and keep tabs on.