There was press coverage this week of an announcement by Royal Dutch Shell indicating they were undertaking major cost reductions and plans to reconstruct their business and prepare to focus more on renewable energy.

We believe this has the markings of something bigger than just another large public company announcing a restructuring. A company with the size and prestige and industry history of Shell signals the shift towards renewable industry and the implicit shift away from traditional oil & gas . . . we need to take note. A major market shift could be starting.

Consider the current environment where during the past months (years?) we have seen the demand for oil & gas has been shrinking, oil prices tanked and OPEC could not seem to get its members together on production and prices this year. Add to that the increasing amount of climate change concerns that may be finally gaining some ground. Add in a pandemic that has significantly affected demand. Plus, one of the biggest symbols of of gas & oil — the automobile — looks to be increasingly like an electric vehicle (can you say Tesla?) world. Putting an exclamation point on it, Gov Newsom of California signed an order phasing out gasoline vehicles by 2035.

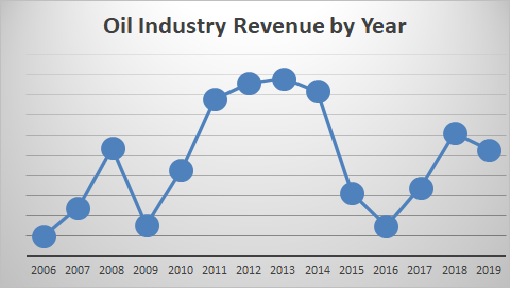

In the broad context of total world economies, a shift to the overall Oil & Gas industry will be felt everywhere. If we look at the 15 major industry sectors across the globe, Oil & Gas is #2 behind financial services. There are 245 Global 5000 companies in Oil & Gas with $6.5 trillion in revenue and employing 6.2 million people. Shell is #3 in the industry behind two Chinese companies and just ahead of Saudi Aramco. This industry, which has been a key component of many country’s GDP, has now become unreliable as an income source and politically out of vogue – take a look at the chart below showing the aggregate revenue of all the Global 5000 Oil & Gas companies.

While all these transitional elements will be in play over the next few years, a key impact will be felt by those organizations that have been selling and providing products and services to the Oil & Gas industry. The same products and solutions may not meet the new need and new focus of companies like Shell. This will ripple thru their forecasts, sales plans, marketing activities – all of which will have to be re-tooled.

We’ll keep watching this over time and so should any firms that focus on Oil & Gas companies.

You can download a copy of our 1-page overview of Oil & Gas companies in the Global 5000 database Oil and Gas Nov2020 doc